Growth Hacking Service Report

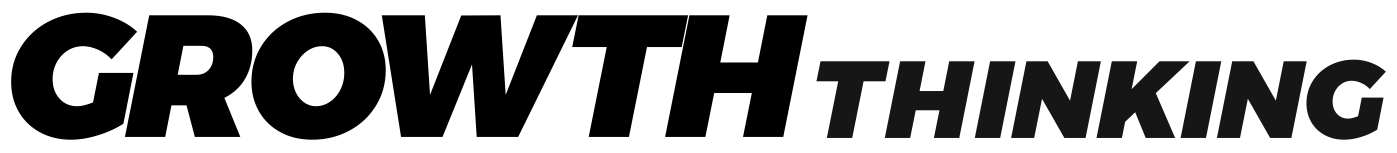

86% OF GROWTH AGENCIES ARE NOT GROWING

Can they help you? - We analyzed 2k growth service buyers here is what we learned.

We surveyed 2,150 growth hacking service buyers with a total spending power of USD 350m in annual spending in an emerging market growing at +350% per year, known as growth hacking services.

We took a deeper look into spending behaviors, the type of growth hacking services in most demand, and switching costs and reasoning.

This study will reveal groundbreaking insights never been undertaken in the growth hacking industry. Let’s take a deep dive into the data.

Summary of key findings

Growth Hacking Service Buyer Report

Growth isn’t about 2x. It’s 10x or 100x

86% of growth agencies are not growing

GROWTH SERVICE BUYER SPENDING

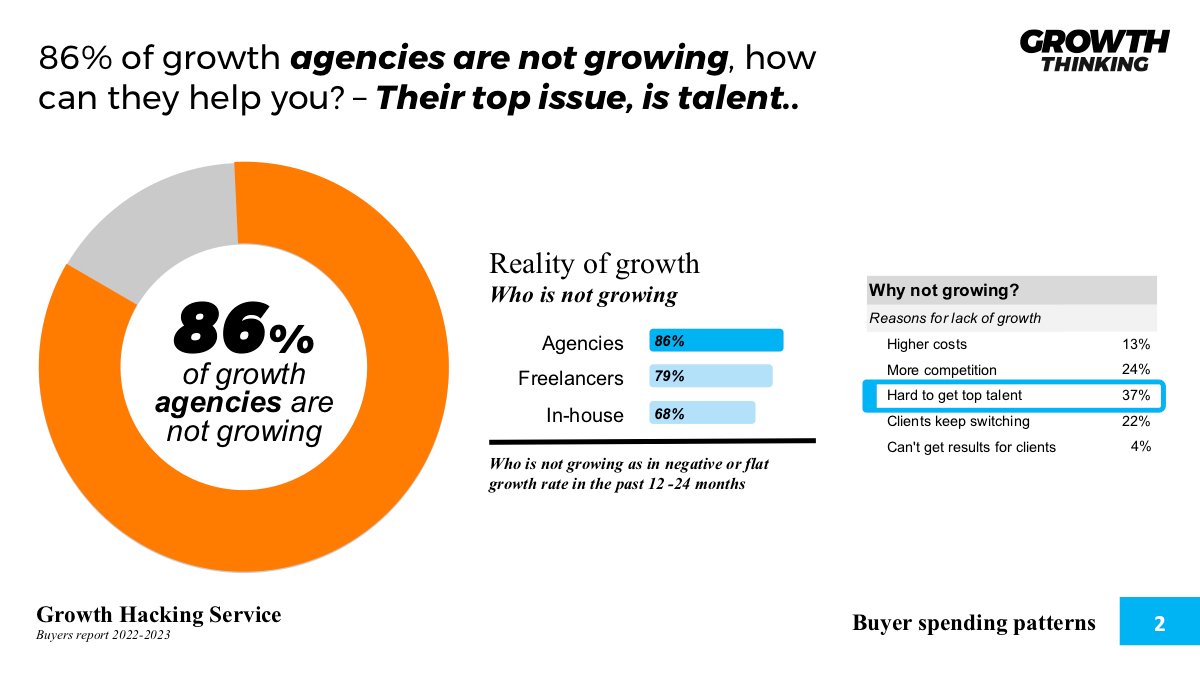

◾ 32% of growth service buyers spend $1,000 or less a month

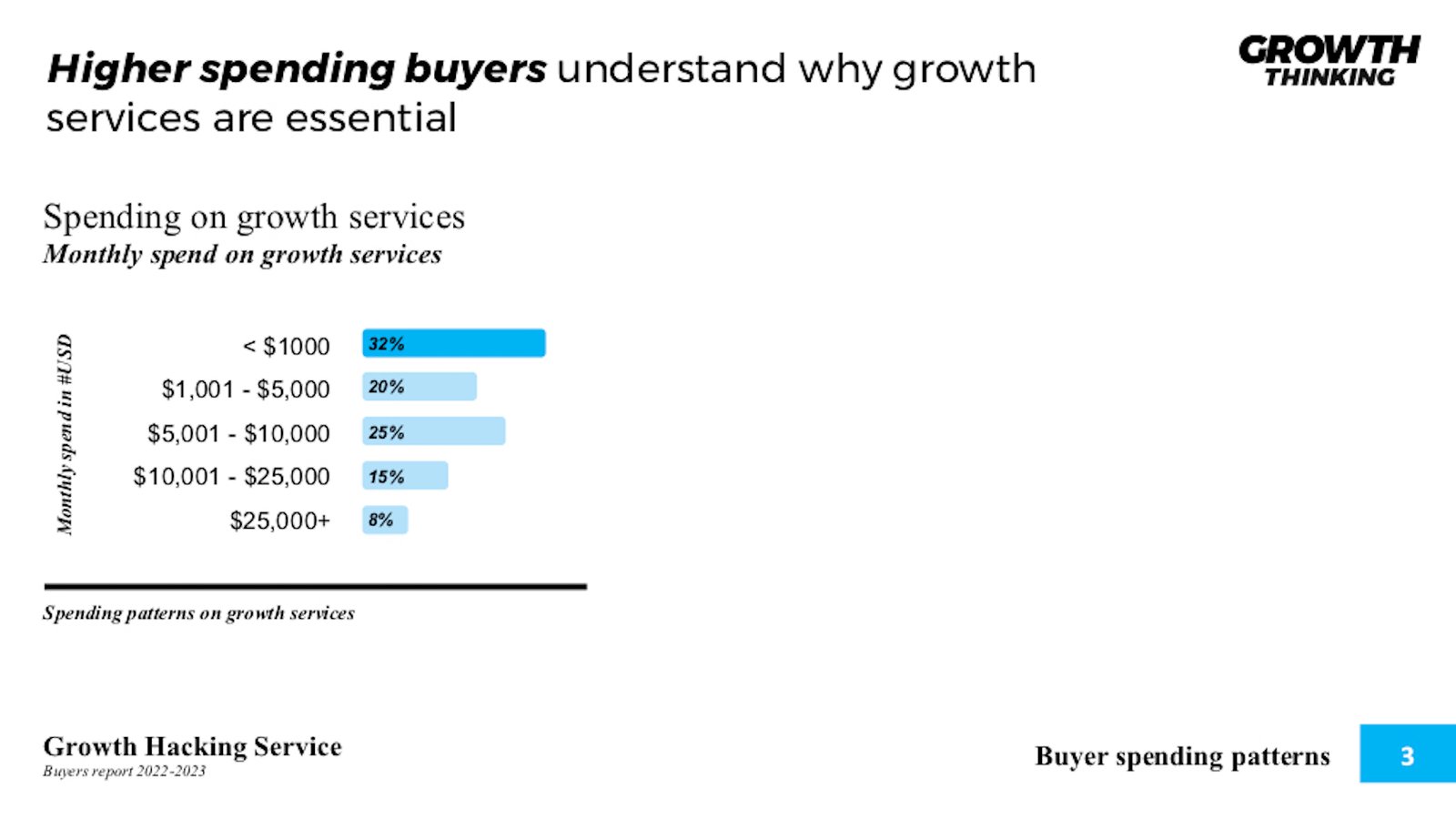

◾ 40% of all contractual service agreements last 3 months or less

◾ 55% of first-time growth hacking services used are from freelancers

◾ On average, 8% of growth services are hybrid services (digital and non-digital).

SERVICE PROVIDER – SUCCESS & ROI

◾ Agencies are growing at 62%: 3x more than freelancers and 2x more than in-house growth services

◾ 92% of freelancers predicted a +50% growth in revenue in 2023

◾ 58% of agencies indicate a growth rate of 10- 50% in 2023§

◾ 30% growth is expected in 2023 for in-house growth services

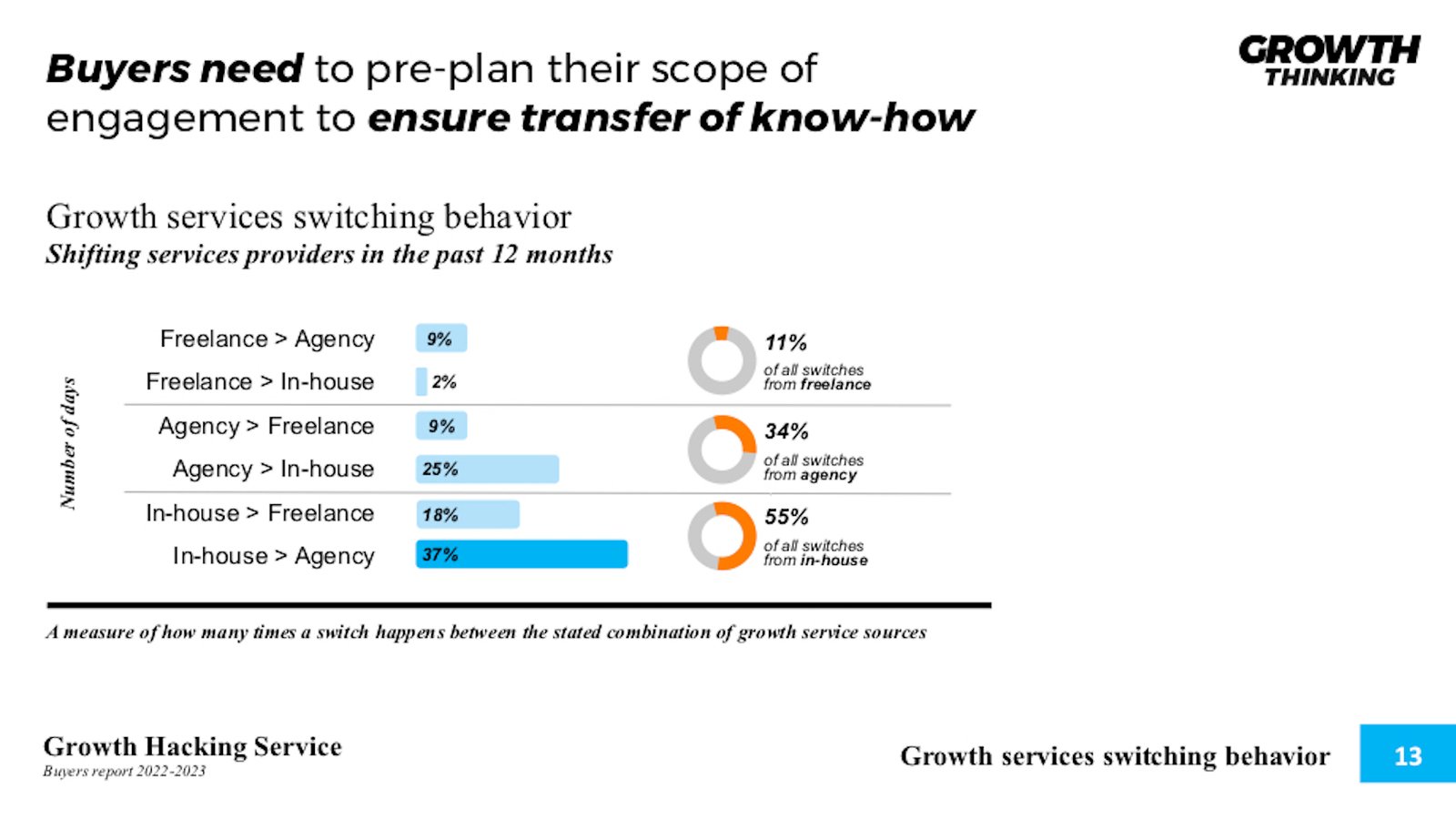

GROWTH HACKING SERVICES SWITCHING

◾ 55% of all switching activity is from in-house back to outsourced services

◾ 251 days is the average switching from in-house to other growth service providers

◾ $48,241 is the average cost to switch from in-house to external providers.

GROWTH SERVICES SWITCHING REASONS

◾ 39% of growth service buyers switch from freelancers to agencies for deeper expertise

◾ 34% of growth service buyers shift from freelance to in-house to gain more control

◾ 41% of switching reasons from agency to freelancer is deeper expertise

◾ 37% of the reasons for switching from agency to in-house is more control

◾ 32% of reasons for switching from in-house to freelance are to cut costs

◾ 43% of reasons for switching from in-house to agencies are bigger results.

CLIENT GROWTH SERVICES EXECUTED

◾ 72% of growth activities are focused on revenue acquisition

◾ The highest focus area is Demand stimulation activities at 74% under retention efforts.

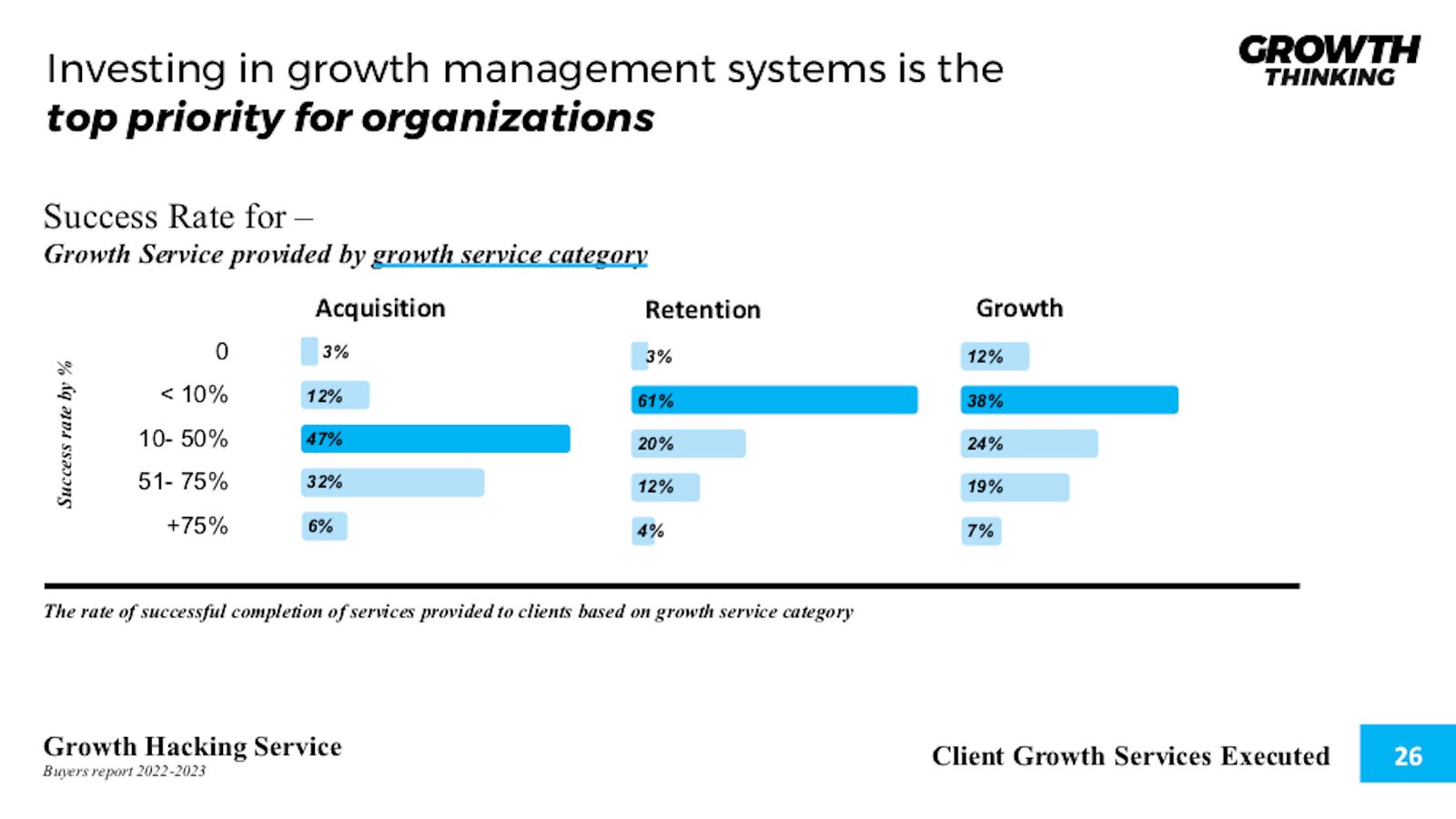

◾ 47% of acquisition activities are between a 10-50% success rate

◾ The highest Return on Investment is in the acquisition stage at 51-100% returns.

“Growth isn’t about 2x. It’s 10x or 100x“

Growth hacking is a fast-evolving practice used by the top unicorns who have shaped how this practice is being developed as it goes mainstream. Such companies as Whatsapp, Dropbox, Airbnb, and Telegram have shaped the way with mind-blowing examples.

BUT, what does this mean to the buyers of such services? Demand continues to grow for growth hacking services, but are those buyers being served well. Ultimately they have three sources of growth hacking services:

- hiring a freelancer,

- retaining an agency, or

- taking it full in-house.

In this study, we explore exactly that, understanding the buying behaviors and unraveling insightful and actionable data for freelancers/experts, agencies, and even the clients themselves to bring their growth hacking capabilities in-house.

Groundbreaking growth and measurable levers

A comprehensive and groundbreaking study, “SaaS Metrics 2.0 – A Guide to Measuring and Improving what Matters,” by David Skok clearly indicates one of the most significant correlation points that lead to massive failure and need to be managed when developing growth processes.

He clearly shows a 10x impact when more money is spent on acquiring clients vs. revenue impact, but the depth to make the acquisition can tip over cash flow and de-leverage growth.

David goes deeper into unit economics which is crucial as data-driven measures to leverage growth and make effective decisions. Although this is mainly for SaaS businesses, such models and techniques can equally apply to other models.

Why Growth Hacking Service buyer report is important

This study helps freelancers, experts, agencies, and organizations, either with an existing or planning to have a growth unit understand service performance. This enables vital strategic decisions like

- Positioning of services,

- Reallocation of resources,

- Enhancing portfolio of offerings,

- Outsource or in-house, or hybrid,

- Switching costs, patterns, and options,

- Spending allocations,

- Expected success rates, and

- The range of return on investment to expect

helps both the buyers of growth hacking services and the providers better align. This study aims to improve the growth hacking service arena for service providers and buyers.

Who is this Growth Hacking Service buyer report for?

This study primarily targets first-level decision-makers who are principal business owners or those who directly work for the principal business owners and those responsible for growth functions. This includes

- chief executive officer,

- chief growth officer,

- co-founder

- coo

- director,

- founder

- growth hacker,

- growth manager,

- growth marketer,

- growth marketing

- managing director,

- owner

- partner

- president.

Although titles and roles may vary per organization, the goal is for primary decision-makers as participants and those who consume and use this study.

How to use the Growth Hacking Service buyer report

This report is to be used as a strategic decision-making source. This helps decision-makers with the following inputs

- The state of growth hacking services,

- Key economic and financial performance metrics,

- Service source and types being consumed,

- Return on investments and success rates as a benchmark, and

- Spending patterns and allocation of services used.

This will help decision-makers decide how to reposition, make better use of service providers, or for service providers to enhance their offerings to become more competitive.

Subscribe for updates

Growth Hacking Service Report

86% OF GROWTH AGENCIES ARE NOT GROWING

Can they help you? – We analyzed 2k growth service buyers here is what we learned.

Lets get started

86% of growth agencies are not growing.

Can a growth agency really help you grow?

86% of growth agencies are not growing, due to 37% of them not finding and retaining growth hackers of top talent. By 2030, 1 million growth hackers (Quoted by Altaf Jasnaik CEO & Founder – MANAGEMEND LIMITED) will be needed, where the current count of industry practices in the growth hacking space is roughly 10-12k.

Negative and flat-line growth has plagued agencies for 36 months, with the highest non-growth rate among freelancers and even in-house growth units. Most growth agencies are established by freelancers or newly arrived talent in the industry most grounded in SEO (search engine optimization).

Growth hacking being a secondary service, agencies focus on the following services, which divert from real growth:

- Web Design,

- Digital Marketing,

- SEO (search engine optimization),

- SEM (search engine marketing),

- Content Marketing,

- Influencer Marketing,

- Conversion Rate Optimization

- Viral Marketing,

- Mobile Marketing,

- CRM (Customer relationship management),

- Landing Page Optimization,

- PPC (pay-per-click),

- Google Adwords, and

- Email Marketing.

Although many components are involved in the growth process, most growth agencies do not purely focus on cross-functional growth hacking itself. This is primarily due to the origins of these firms starting with online marketing and other optimization functions only. Growth Hacking is beyond marketing only; it incorporates many functions like focusing on top-line growth as the driving result for exponential growth.

Most growth agencies have growth hacking as a secondary-level service. Clients seeking growth from a growth hacking agency must ensure that the agency or freelancer is using the best practices of growth hacking. One of the key indicators to look for is to ensure they are cross-functional, not just focus on marketing alone.

expert opinion

"biggest challenge these growth agencies believe they face being an acute lack of talent, one is forced to wonder whether these agencies have got it all wrong?"

When one ponders over the data from as high a perspective as one can draw, several questions come to mind. The most prominent being that the lack of growth amongst growth agencies and facilitators indicates how much or not their clients are growing.

The challenge behind all growth is the attainment of satisfaction with one’s results and this subset studied seems to either be satisfied with what they have achieved or unaware that they need a shot of the medicine they have to offer others.

What fascinates me most in studies like these is the granular findings. With the biggest challenge these growth agencies believe they face being an acute lack of talent, one is forced to wonder whether these agencies have got it all wrong?

I would like to postulate the theory that there isn’t a lack of talent, its just that one needs to learn where to find them and more importantly how to engage them.

The great resignation has been vaunted in very many ways, however it is proof that there isn’t a talent shortage, just that businesses need to know how to apply them.

Higher spending buyers understand why growth services are essential

Spending on growth services

32% of growth service buyers spend $1,000 or less a month. The highest spenders who spend $25,000 and more a month are 12% below the average spending ranges studied.

Although this doesn’t seem far off, those spending $25,000 and more a month are only 8% of all growth services consumed.

A question asked on Quora.com, “Does outsourcing growth hacking for $1,000/month make sense for your startup?” states that it is dependent on how tight the product-market fit is. Answered by Andrew Constable

Background

Most buyers see growth services as a secondary priority designed to support their products/services, and hence they do not prioritize spending. 23% of growth service buyers spend $10,000 – $25,000 a month with a fundamentally different perspective on growth services than those who spend below this range.

Context

Higher range spending buyers have a great understanding of their growth requirements, usually driven by either an internal need from a growth expert or an external funding source like a venture capital firm that highly encourages them to have a growth capability as a priority.

Takeaway:

Higher spending buyers understand why growth services are essential and are willing to spend the premiums required for better quality services. Better quality services constitute a robust and more sophisticated strategic offering.

Short-term thinking outright kills growth - exponential growth is a long-game

Duration for growth services

40% of all contractual service agreements last 3 months or less, stimulating high switching rates and higher failure rates

According to McKinsey & Co., 65% of executives and directors say short-term pressure has increased over the past 5 years leading to poorer performance overall.

Background

Lower spending clients with less experience and a lower priority rate for growth spend less on growth services and don’t commit long enough to get real results.

Context

As a result of short-term thinking and low budgets, clients face limited results, often leading to massive frustrations and low returns on investment.

Takeaway

8% of contract durations are between 12 – 24 months, which is the ideal timeframe for actual growth results to emerge. Given the current volatile and turbulent market conditions, time is needed to make the proper adjustments to gain sustainable and exponential growth.

Subscribe for updates

Agencies and freelancers can be ahead of the curve by helping clients with internal processes

Source of growth services

55% of first-time growth hacking services used are from freelancers; by the time they reach their third purchase of growth services, freelancers drop to 8% and become the last resort source.

Whereas 58% of clients who have used growth services at least 3 times have a switching pattern of — starting with freelancers, shifting to agencies, then finally interna

$72,000- $257,000 is the compensation range for an expert growth hacker exclusive of other benefits, including profit sharing equity and other perks.

Background

Clients dip their feet into growth services with the least risk by spending the least money to start with. Hence, freelancers are most posed to obtain new clients on a small scale, but with the potential to dramatically scale their revenue before clients switch to an agency.

Context,

The driver behind switching is based on return on investment and final results. There is a direct correlation between the total spend, contract duration, and service provider source. This is why freelancers are the first point of protocol for clients to pursue to test out the waters. The challenge is that the scope of services is usually very limited and short-term oriented. Hence this is why clients switch to agencies to identify a broader range of expertise and support.

Takeaway:

Most clients will have a significant portion of their growth services in-house, and freelancers and growth agencies knowing this early can provide a massive opportunity. This opportunity is to enable clients to become self-dependent eventually.

expert opinion

"simplicity and data-driven guidelines will help you create and maintain content that attracts organic visitor"

Growth has many forms; at Surfer, we focus on organic traffic growth as part of your digital marketing strategy.

With a tool like Surfer, it does not matter what you do and whether you are a marketing professional or professional at your trade with a bit of tech curiosity. Either way – simplicity and data-driven guidelines will help you create and maintain content that attracts organic visitors.

Freelancers get their precious time back for creative work while the tool is calculating all available low-hanging fruits. Agencies can take on more clients without scaling up the team, and here I have first-person experience, as Surfer is an agency turned SaaS.

Yet business owners and in-house teams probably get the most value, which are years of expertise refined into an actionable list of improvements for their websites.

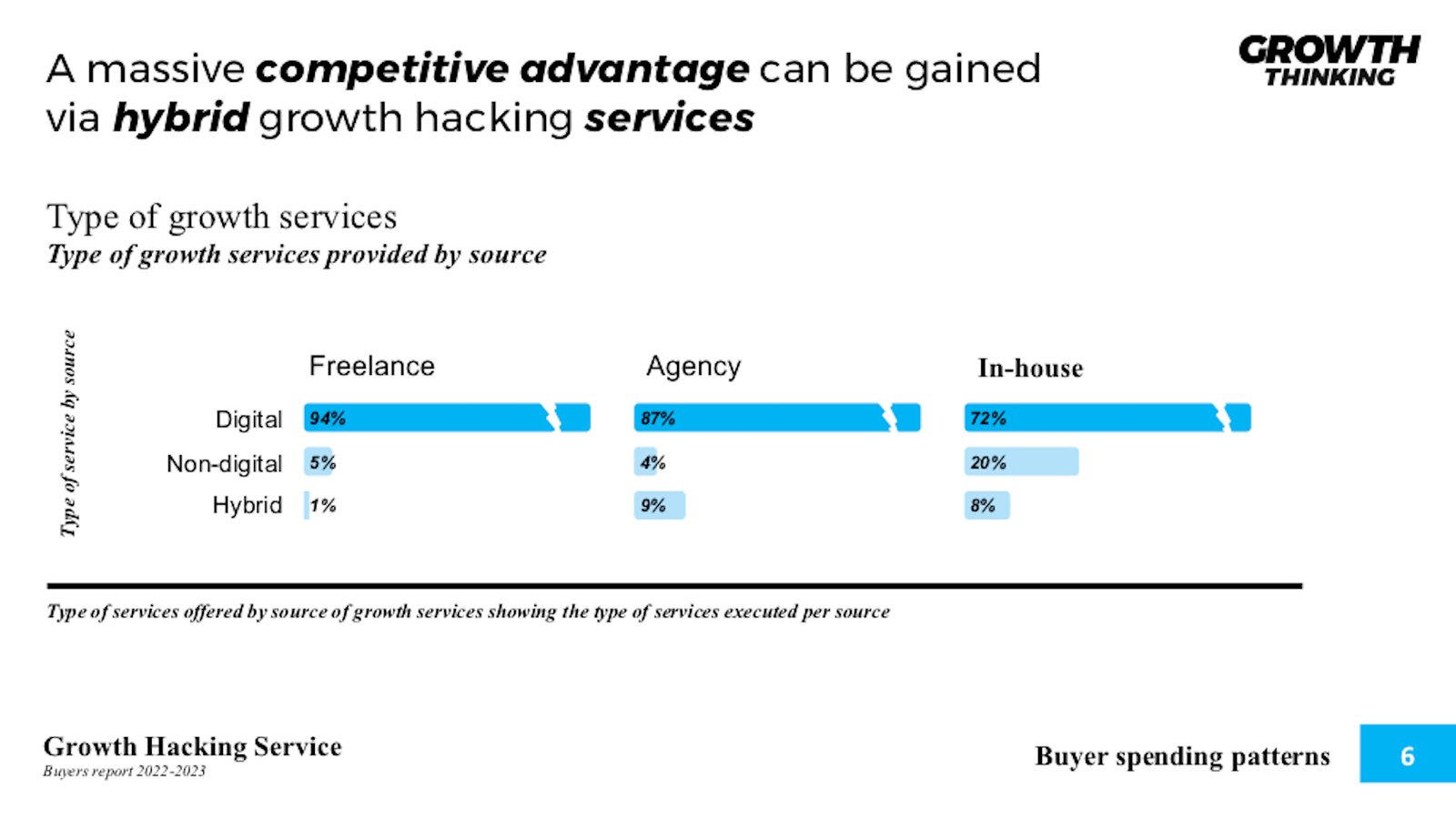

A massive competitive advantage can be gained via hybrid growth hacking services

Type of growth services

On average, 8% of growth services are hybrid services where digital and non-digital means are used for growth. As well, 84% of growth services, on average, are purely digital-related services. The dramatic shift into hybrid services is when clients take control of their growth and shift their efforts in-house.

In 2022, spending on digital transformation is projected to reach 1.8 trillion U.S. dollars. By 2025, it is forecasted to reach 2.8 trillion U.S. dollars.

Background

Most buyers’ perceptions are that growth hacking and growth services are exclusive to digital services only. This narrows strategies into a single funnel of thinking which omits massive strategic opportunities both using digital and non-digital strategies into a single hybrid service.

As stated by SalesBread “20-55% of prospects will accept personalized messages” However, when digging deeper, the daily response rate is 2% making digital outreach alone not enough to sustain quality leads.

Context

While a minority of clients focus on hybrid services; they are the ones who engage in longer-term contracts and higher spending as they have realized the importance of cross-functional growth hacking. This essentially means several functions need to be incorporated into the growth strategy. This gives a massive competitive advantage as competitors are singling themselves out naturally by only focusing on a narrow set of digital strategies.

Takeaway

A massive competitive advantage can be gained via hybrid growth hacking services where they can tap into both digital and non-digital means. This is very apparent regarding front-line revenue acquisition strategies, especially with outreach activities. While many companies get focused on digital outreach and see their results dramatically decline with time, those who employ a hybrid approach see the opposite results.

expert opinion

"Most agency founders focus on one channel and become subject matter experts. But your customer requirements evolve over time"

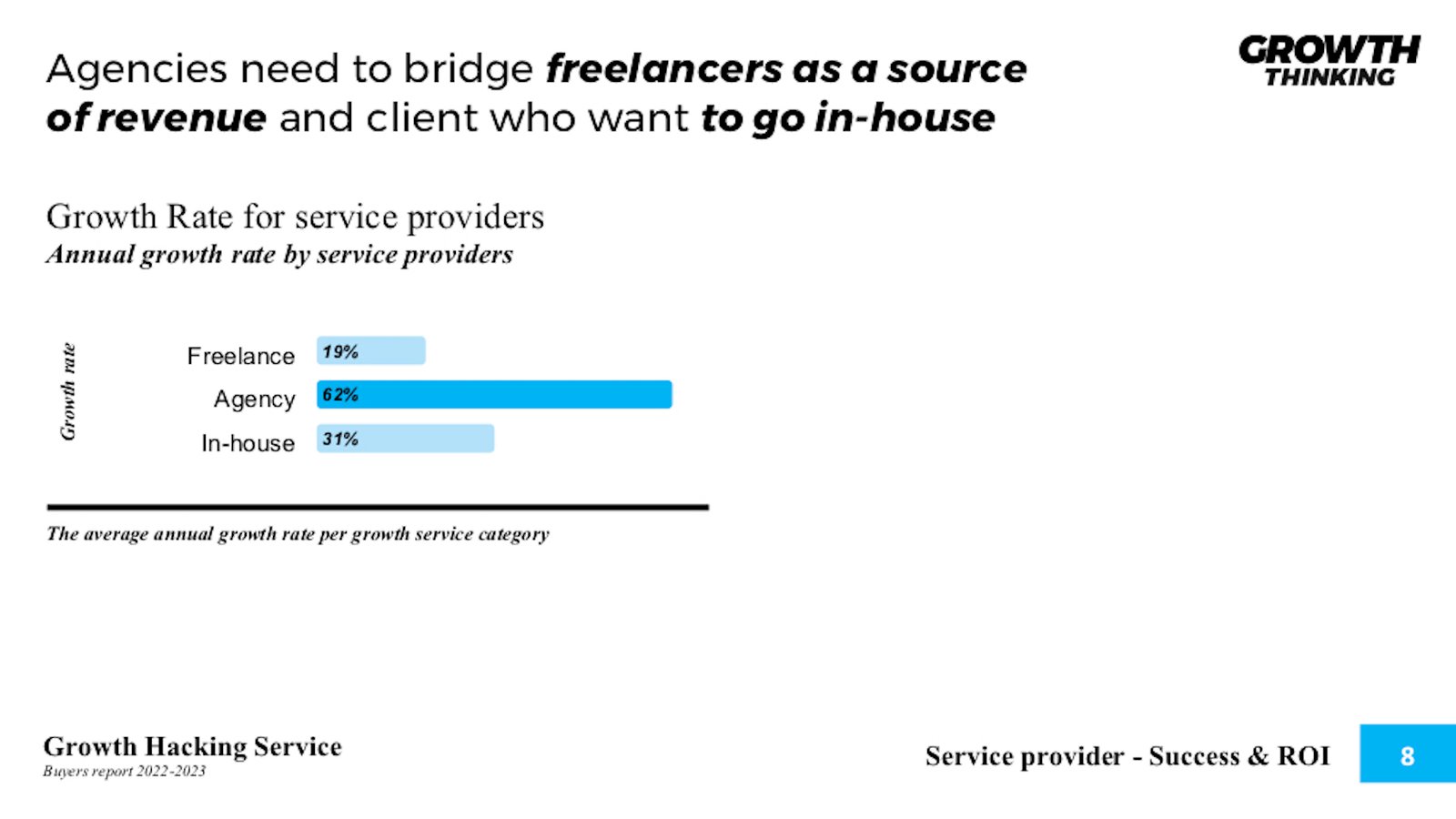

Agencies need to bridge freelancers as a source of revenue and client who want to go in-house

Growth Rate for service providers

Agencies have the highest growth rate at 62%, which is 3x higher than freelancers and 2x more than in-house growth services. Agencies sit in a sweet spot, where freelancers feed them upstream businesses.

Since 2017, the average digital agency has grown its revenue by about 15% annually. Meanwhile, there are 58 million freelancers in the US, contributing $1.4 trillion to the U.S. economy, and they are poised to become the majority workforce by 2027.

Background

Agencies are seen as a safe bet. They are not freelancers who can disappear and not deliver, and it’s not in-house, creating internal administrative costs, etc. Clients can put liability squarely on agencies, and this is why they are the fastest-growing segment of type of growth service providers.

Context

Agencies do not see freelancer opportunities as primary drivers based on their failure to deliver on client needs. The challenge is when clients shift from freelancers to an agency; they are usually accustomed to lower spending and shorter commitments that don’t work for the agency model.

Takeaway

Agencies need to find bridging between incoming freelancers and client work being taken into in-house activities. Agencies need to capitalize on this bridging opportunity. The issue with this is most agencies only see other agencies as competition, not freelancers, and take services in-house from their clients.

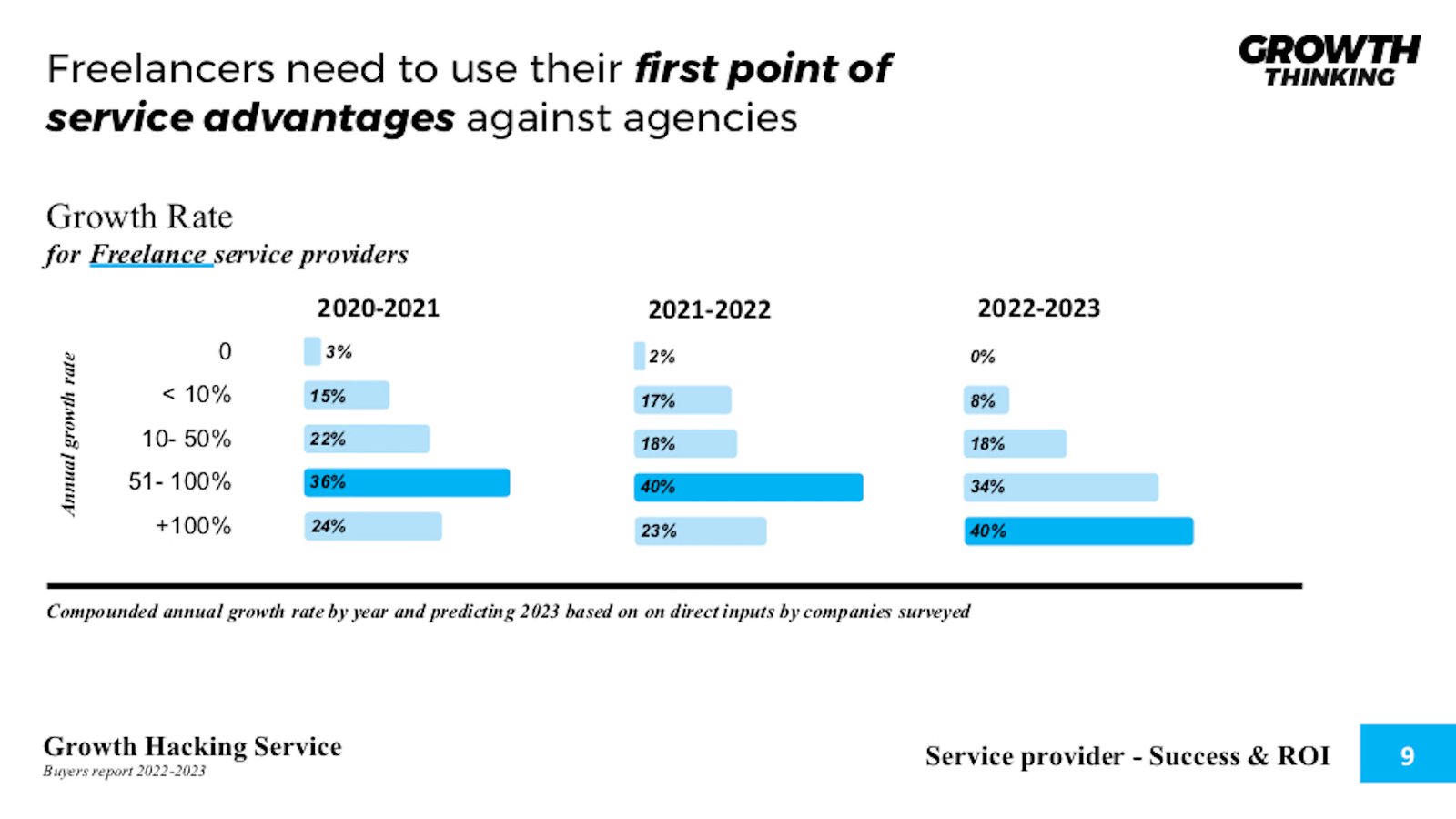

Freelancers needs to use their first point of service advantages against agencies

Growth Rate for Freelance service providers

92% of freelancers predict a +50% growth in revenue in 2023. This is double the 2021-2022 results. Their confidence is based on industry growth.

In the United States, the Freelance workforce is growing 3 times faster than the overall US workforce and earn the most, with year-on-year revenue growth of 78%

Background

As the growth and growth hacking industry grows, freelancers are tapping into the overall growth of the industry and basing their prospects on this growth. They are offering micro-services catered towards newly educated clients or clients with low-medium level experience knowing what they want.

Context

Although freelancers expect more growth, being the lowest barrier entry point for growth services, they face the highest competitive pressure. The majority of freelancers offer very similar looking and sounding services. As freelancer marketplaces help determine performance quality by reviews, this often can be misleading for many reasons. Hence clients test their services out on microservices with tiny scopes.

Takeaway

Freelancers will have difficulty differentiating their offerings in a highly competitive yet rapidly growing industry. Freelancers will need to focus on micro-services targeted toward growth service buyers who have purchased growth services three times or more within 18 months, giving them a fighting chance to profit from their superpowers.

Subscribe for updates

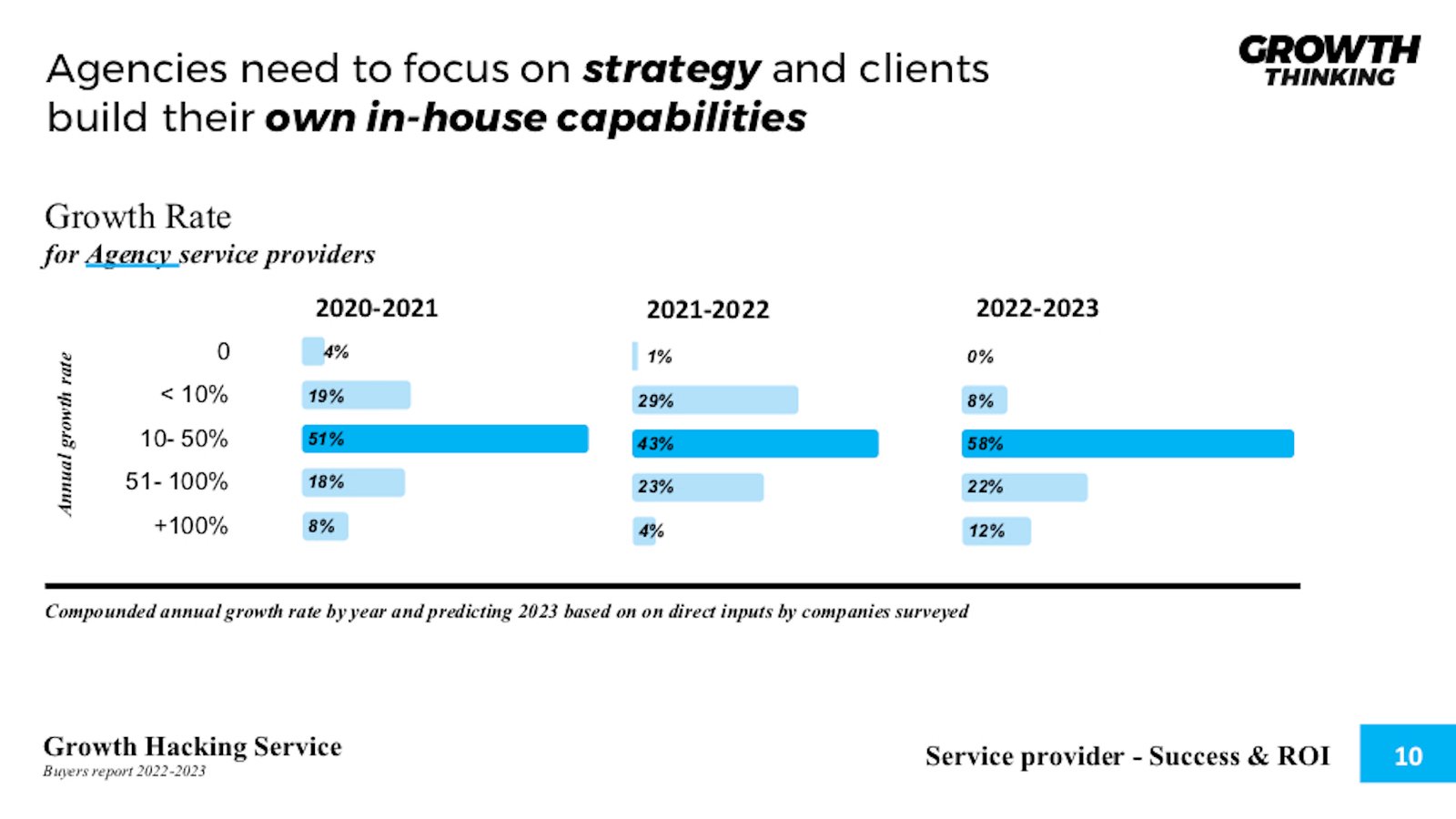

Agencies needs to focus on strategy and clients to build their own in-house capabilities

Growth Rate for Agencies service providers

58% of agencies predict a growth rate of 10- 50% in 2023. A dip in growth in 2022 is due to a more competitive environment based on aggressive agency-to-agency competition.

Agencies of all disciplines (advertising, marketing, digital, and public relations) saw their revenues fall by 6.8 percent compared to the previous year

Background

Agencies have seen a decline in 2022 due to clients not being able to determine which agency would best serve them. The buying decision is complex due to:

- Many confusing offerings,

- Unclear service offerings,

- Overlapping services,

- Overemphasis on pure digital offerings, and

- Over automation of client servicing compromising relationships.

Agencies have a lot of work to solve client servicing challenges to gain longer-term contracts with higher revenue-generating clients in the long term.

Context

Agencies will find many of their peers in 2023 dropping out or transforming into purely digital agencies mainly focused on SEO services. Although this may mean fewer players competing for the same or more clients, this creates more growth service buyer confusion. Onboarding is one of the most significant failure points for agencies 63% of customers say the level of support they’re likely to receive post-sale – is an essential consideration in whether they decide the first place

Takeaway

Agencies see a clear path to growth in 2023. Those at the helm of this are mastering deeper and better client servicing formats. This is led by a strong focus on strategy, assisting clients in the internal recruitment of growth talent, and expanding on customized microservices on a client-by-client basis.

expert opinion

"As your agency continues to grow you need to lock down your customer acquisition and sales processes"

Growth hacking training is not up to standard for what clients need

Growth Rate for In-house services

30% growth is expected in 2023 for in-house growth services. This is essentially clients taking more control of their growth internally and seeing direct correlations between their effort and return on investment.

Today 91% of those involved in in-house growth teams are from a marketing background. As well as, 86% of people say they’d be more likely to stay loyal to a business that invests in onboarding content that welcomes and educates them after they’ve bought.

Background

Only in the last 24 months have clients who have purchased growth services 3x and more realized the importance of in-house development. This doesn’t mean entirely bringing growth hacking into their organization but at least the most critical components. This usually is the starting point when clients realize they can do it themselves but need specialized micro-services from experts in the field to support internal growth.

Context

Clients are eventually shifting to in-house growth services as their growth requirements become steeper, and agencies and freelancers will not be able to service them at the same level of quality. This creates a massive gap in results vs. efforts and, eventually, a return on investment.

Takeaway

This enormous shift to in-house puts significant demand on high-end growth hacking training and courses specifically focused on their growth requirements. The most critical area will be in two places, first is sophisticated growth strategies, and second, link those strategies to data-driven systems that speed up experimentation.

expert opinion

"We have seen customers achieving up to 10x productivity in building apps using Creator instead of PHP or Node. JS."

When growing, you always compete against time and rapidly changing market realities. You will need tools (technology) that are easier to obtain and set up to help you keep the costs, dependencies, and risks down.

Zoho helps achieve all of the above by providing a unified platform that allows the tech and data to remain internal and easier to manage. At the same time, the talent and growth expertise can be outsourced.

With Zoho Creator, for example, non-IT teams with little to no development background can build apps to automate complex processes and scenarios that otherwise need to be outsourced to build. We have seen customers achieving up to 10x productivity in building apps using Creator instead of PHP or Node. JS.

It is worth noting that such apps can then easily consume and process data coming from the CRM, Campaigns, or Books and then push the output to other (internal or external) services. Users can also visualize data and turn it into digestible information within Creator, or on Analytics, among other things.

Globally, we’ve seen an average of 15% to 30% growth in the usage of these apps in 2021 alone, compared to the previous year. Interestingly, these numbers jump to 20% to 40% growth in the same timeframe. Looking at our growing number of 75 million users, these growth numbers indicate an increased focus of organizations in bringing in such capabilities in-house and investing in the right tech and skills.

Growth Hacking Service buyers need to pre-plan their scope of engagement to ensure transfer of know-how

Growth services switching behavior

55% of all switching activity is from in-house back to outsourced services. This is a reverse flow due to several reasons.

60% of the actual expenditure can be saved through outsourcing growth hacking techniques for your respective projects.

Background

Know-how management is the most significant source of failure when switching. As growth service buyers evolved through the process of using freelancers and agencies and eventually going in-house, the switching transitions were not done well. This means poor handovers, little to no transfer of know-how, and a fragmented shift of proprietary know-how. These inclusions, tooling, strategies, operational protocols, and the loss of critical data

Context

It is not in the interest of freelancers and agency clients to gain full capacity on their growth capabilities. This is highly evident when switching from external to internal. However, this also indicates an internal failure of the capability to operate growth services internally. The switching costs are very high in this case and something that clients will eventually resolve.

Takeaway

Growth service buyers, when shifting from external to internal, need to pre-plan their scope of engagement to ensure the transfer of know-how, including all created materials and data. This can include but is not limited to the creation of tools or specific third-party accounts that have critical data that might not be visible to the client.

Growth service buyers need to manage their intellectual property, which can cost them $3 million

Duration of services before the switch

251 days is the average switching period for in-house to external growth service providers. This has an average of 69% retention rate before switching to different service providers like in-house to agency or freelancers.

Outsourcing growth hacking increases productivity and competitiveness 10-to 100-fold. To achieve such results, deep expertise in growth hacking is needed.

Background

The investment of time, resources, and efforts in in-house growth services makes switching costs and time more of a barrier. Therefore, once growth services go in-house, the duration is much longer before a decision to switch to another service provider is made. The investment internally is too high, discouraging switching to external service providers.

Context,

The Primary driving factor of an increased switching time is the sensitive nature of growth activities from the inside out. This means that clients are apprehensive about being highly confidential data given to a third party. This presents a very serious and harmful outcome that may emerge, entailing more time is needed when a decision is made to switch from in-house to external services.

Takeaway

Regardless of switching patterns, growth service buyers have to be prepared to manage their intellectual property very carefully, giving them the versatility to switch between service providers. The theft of Intellectual property in the US costs between $225 billion to $600 billion annually, while the average cost of a data breach is $8.64 million. Additionally, defending a patent lawsuit can exceed $3 million.

expert opinion

"outsourcing growth doesn't work for the following reasons ownership, deliverability, and agility. "

The data points are not surprising to me, outsourcing growth doesn’t work for the following reasons ownership, deliverability, and agility.

Startups, especially pre-Series B companies are often trying to find their product-market fit, and the growth team would usually champion that exercise.

Besides the fact that no one would know your product better than your in-house team, it takes a lot of experimentation for a company to achieve PMF yet the external source would be blamed for a product that can’t sell. And even when an external agency knew what to do, they would still need to go over a round of approvals, and opinions which would result in a failure in one of the core fundamentals of growth hacking- speed. Expectations gap can also be another reason growth agencies & freelancers would fail.

A big part of experimentation is failure and growth hacking is not as simple as digital marketing. You will experiment and fail multiple times, and clients won’t have the capacity to both pay you and understand that.

Agencies and freelancers can yield higher premiums helping clients develop internal growth

Cost of service switching

$48,241 is the average cost to switch from in-house growth services to external providers.

The most cost switch is from in-house to agencies at $29,567 every time a switch of prover happens.

In-house to external costs are 10x more than switching from freelancers making freelancers the least costly switching source and mainly freelance to In-house being the lowest switching cost.

76% of companies see CLV (Customer lifetime value) as an important concept for their organization but rarely master it, especially understanding acquisition and switching costs.

Background

Switching between the same service providers is natural. It is at a lower cost, like switching from one agency to another, but when switching between service provider types switching costs dramatically go up. Switching costs have both tangible and intangible costs associated with them. What is measured in this study is tangible costs only. Intangible costs can easily range from 3x to 15x more than tangible costs. Some of the intangible costs established by growth service buyers are

- Cost of not seeing all the data collected or used by a service provider,

- They are not getting all the data in both raw and analyzed format for further usage,

- Losing access to tools with proprietary data is not transferred over to clients,

- Know-how not documented by a service provider that has not been transferred over,

- Denying access to tools and data in whole or in part as a penalty, and

- Kill fees in termination clauses that prevent the freedom of movement of clients

Context

Switching will happen and needs to be managed from the start assuming the provider will provide satisfactory service, but with a security blanket. This security blanket must be governed by the client and managed very carefully, as intangible costs can spiral just on a small item that was missed or not calculated.

Takeaway

Growth service providers will either govern the switching process themselves or expect the client to assist them. This premium service component that freelancers and agencies can offer yields higher prices for their services. This will be justified by the extra effort of providing a balanced relationship between the client and the service provider.

expert opinion

"When planning for growth is the cost of the tools you utilize to achieve that growth"

One of the key points to factor in when planning for growth is the cost of the tools you utilize to achieve that growth. This includes both tangible (licensing costs, etc.) and intangible (adoption, data migration, etc.) costs, the latter of which is often overlooked.

Most Zoho apps are tightly integrated to maximize a seamless data flow between the CRM, the Analytics, and Campaigns, all of which are critical building blocks of a successful growth strategy.

Also, Zoho apps are integrated with zero coding, either out of the box or using Zoho Flow with a myriad of apps and services while allowing deeper REST API integrations for more complex scenarios.

What’s better is that all these are achievable at a very reasonable cost with minimal training, as well as the ability to easily import your data from virtually any other platform into Zoho. You can also move your data out of Zoho, facing no obstacles if you need to switch to another provider or archive your data.

With Zoho, you are the sole owner of your data and processes.

Subscribe for updates

Expertise have a stronger correlation to getting results compared to cost service

Shift Freelance > Agency

39% of growth service buyers will switch from freelancers to agencies due to the need for deeper expertise. Deeper expertise is 10x more reasons for switching from low-cost services.

Retaining existing customers spend 67% more on average than new customers hence why deeper expertise to tap into existing customers is vital to growth. It’s a low-cost and much easier activity than most business leaders will estimate it to be.

Background

As growth service buyers switch from freelancers to agencies, they see deeper expertise with agencies. However, they also see more reliability for continuity and liability for responsibility with agencies. This can be triggered by freelancers:

- Not performing.

- Not getting a return on investment.

- Not delivering quality services.

- Not meeting basic expectations. And

- Not working enough Context quickly

Unless a freelancer can demonstrate unique and valuable services with direct results, the client will feel safer working with agencies. Although this might not be the exact situation, as agencies have other complexities, this can fail. It would take a significant failure point by a freelancer to trigger a switch.

Takeaway

Not everything is about cost, as expertise has a stronger correlation to getting results than low-cost services. Such growth service buyers have a much more pressuring agenda on return on investment largely due to clients having a more acute sense and deeper analytics on their growth situation.

Freelancers need to broaden their offerings to support in-house switching

Shift Freelance > In-house

34% of growth service buyers shift from freelance to in-house to gain more control over their processes. Secondly, better quality accounted for 23% of why they switched.

The probability of converting an existing customer is between 60%-70%; hence owning your customer relationships and customer acquisition processes are critical to overall growth

Background

Freelancers have been seen as a riskier option, but due to lower costs and faster engagement, they are reasonable short-term solutions for growth service buyers. Once there is a lack of results or other poor performance-related issues, growth service buyers naturally tilt towards gaining more control to get better quality results.

Context

Control and quality are very heavy internal-driven purposes for any organization that would largely apply to all functions, not just growth, for example, production operations and even human resource services. These would predominantly be large organizations that have +500 employees and do over $250 million in gross revenue annually.

Takeaway

Freelancers need to consider broadening their offerings to support in-house switches and continue external support. This gives both parties the flexibility to get superior results meanwhile having a grip on quality and control. It is also advisable for growth service buyers to have their controls and quality checks clear and use them to govern relationships with freelancers.

Deeper expertise is best built internally as it yields a better long-term return on investment

Shift Agency > Freelance

41% of switching reasons from agency to freelancer is deeper expertise. This is followed by 21% for achieving lower costs. The combination gives growth service buyers the advantage of more refined expertise for better results and saves money at the same time.

Acquiring a new customer is between 5x and 25x more expensive than retaining an existing customer; hence focusing on retention work with internal processes enables lower front-end costs.

Background

Agencies are initially seen for their deep expertise, but when a growth service buyer switches for deeper expertise, a few things occur. When agencies fail to

- Provide good training for their expertise,

- Provide updates and upgrades in training,

- Do not empower their people to engage better with clients,

- Limited resources are provided to service their clients,

- Over promising and not delivering, and

- Not changing client requirements fast enough.

Context

When agencies fail to deliver deeper expertise, the next source is freelancers because if they had those experts internally, they would have used them. The reason they don’t have them internally is they don’t have the network or capacity to attract, retain and nurture the right talent internally.

Takeaway

Deep expertise is best built internally as it’s a better long-term investment that has yielded a better return on investment. However, it comes with challenges related to recruitment and talent management. Additionally, having good quality growth management tools and processes internally is vital to making this work.

Agencies need to enable the client to have more control over their own processes

Shift Agency > In-house

37% of the reasons for switching from agency to in-house are more control. As before, freelance to in-house management as the driver. This is followed by quality, then lower costs.

85% of companies with less than 10 employees have three people or fewer in roles that involve growth, according to The State of Growth 2021

Background.

When agencies fail to deliver results, growth service buyers see in-house as a more viable source than before choosing to go with agencies. This security blanket that superficially is created by agencies in many cases isn’t true. Roughly 8% of clients feel their growth agencies have served them well. This means in alignment with their expectations are reasonably met. Often agencies focus on short-term results to gain client confidence, which later proves to be a risky strategy as they cannot sustain such results.

Context

Moving towards more control and quality is always an in-house-driven reaction. Often it is not planned well, and hence a very high tangible and intangible cost is paid when switching. Agency-to-agency switching happens 85% before a client decides to switch service categories, like switching to a freelancer or bringing their growth services in-house.

Takeaway

The opportunity for agencies to deliver better quality results is possible. Still, they need to do this at the very start of the relationship and enable the client to have more control over their processes. Once a client switches service categories like from agency to freelancer, the likelihood of switching back is much lower than staying within the same category.

Buyers need to build internal processes regardless if they are working in-house or not

Shift In-house > Freelance

32% of reasons for switching from in-house to freelance is to cut costs. In most cases, in-house growth services are relatively reliable but do not get the desired results. Hence this drives the decision to improve return on investment by lowering costs.

According to The State of Growth 2021, 51% of challenges faced by in-house growth services are managing the growth process itself. This is followed by managing growth experiments which is one of the most significant drivers behind poor performing growth units,

Background

When in-house growth services are not managed effectively due to a lack of expertise in running growth units. It is known in silicon valley that it is harder to hire a growth hacker than a CEO. The science of growth is a newly emerging practice, and hence the population of experts is very scarce. It is estimated that by 2030, 1 million growth hackers will be needed (Quoted by Altaf Jasnaik CEO & Founder – MANAGEMEND LIMITED). One of the early signs of the science of growth being scarce is in an article in 2013 titled: “The new weird science of growth hacking: What it is and how to implement it”

Context

When asked, “How many experiments become permanent processes?” in The State of Growth 2021, less than 25% of those processes become part of their operations. This leads to one of the most significant failure points in the growth hacking cycle, mapped out in Ready Set growth Hack as “Full-Scale operations,” where 91% of failures happen. It is an elusive stage as it is the last part of the growth hacking cycle. If success has happened up to this point, overconfidence will fail at the stage of “Full-scale operations.”

Takeaway

Growth service buyers will need to build robust internal processes regardless if they are working in-house, hybrid, or outsourcing with the scarce talent pool and little known about the processes that work effectively due to the high level of secrecy in the growth hacking field. This makes in-house processes challenging to develop and manage.

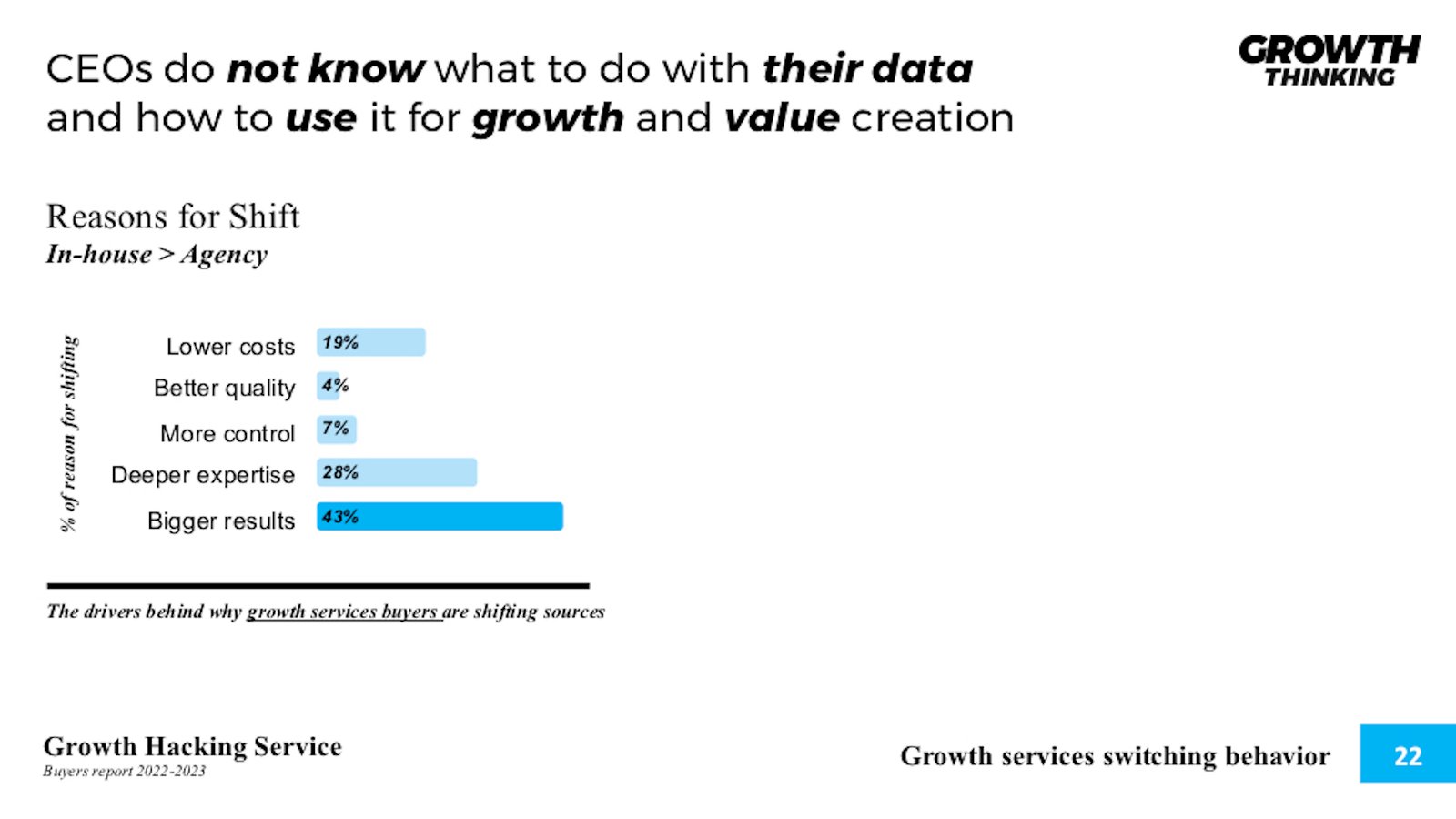

CEOs do not know what to do with their data and how to use it for growth and value creation

Shift In-house > Agency

43% of reasons for switching from in-house to agencies are more significant results. This is a clear indicator of a failed or falling in-house practice trying to survive.

62% of growth team’s have 1-3 people according to The State of Growth 2021, which indicates that few resources, in general, are allocated to growth teams.

Background

According to Growth Marketing Genie, 46% of growth challenges come from a lack of talent and internal support. Internal support and talent are vital to building real growth, which is why growth teams fail. This is where growth agencies fill in the gap in theory. But that in itself has its challenges.

Context,

One of the main drivers going to a growth agency, is its data-driven capabilities that can support decision-making, and this has a two-fold challenge. First, the client doesn’t know what to do with their data. Secondly, the agency doesn’t understand its client’s business well enough to make sense of its data. 75 percent of business leaders admit that 4 percent of their data is used effectively, according to a study undertaken by PwC and CIO magazine. Additionally, 43 percent of companies obtain a little tangible benefit, while 23 percent get no benefit.

Takeaway

In all reality, CEOs, and founders do not know what to do with their data, let alone how to convert that data into growth. At the same time, 16 percent of business leaders do not believe their organizations know what data it has, while 23 percent do not know where data could be used best, and 20 percent do not know how to gain value from their data.

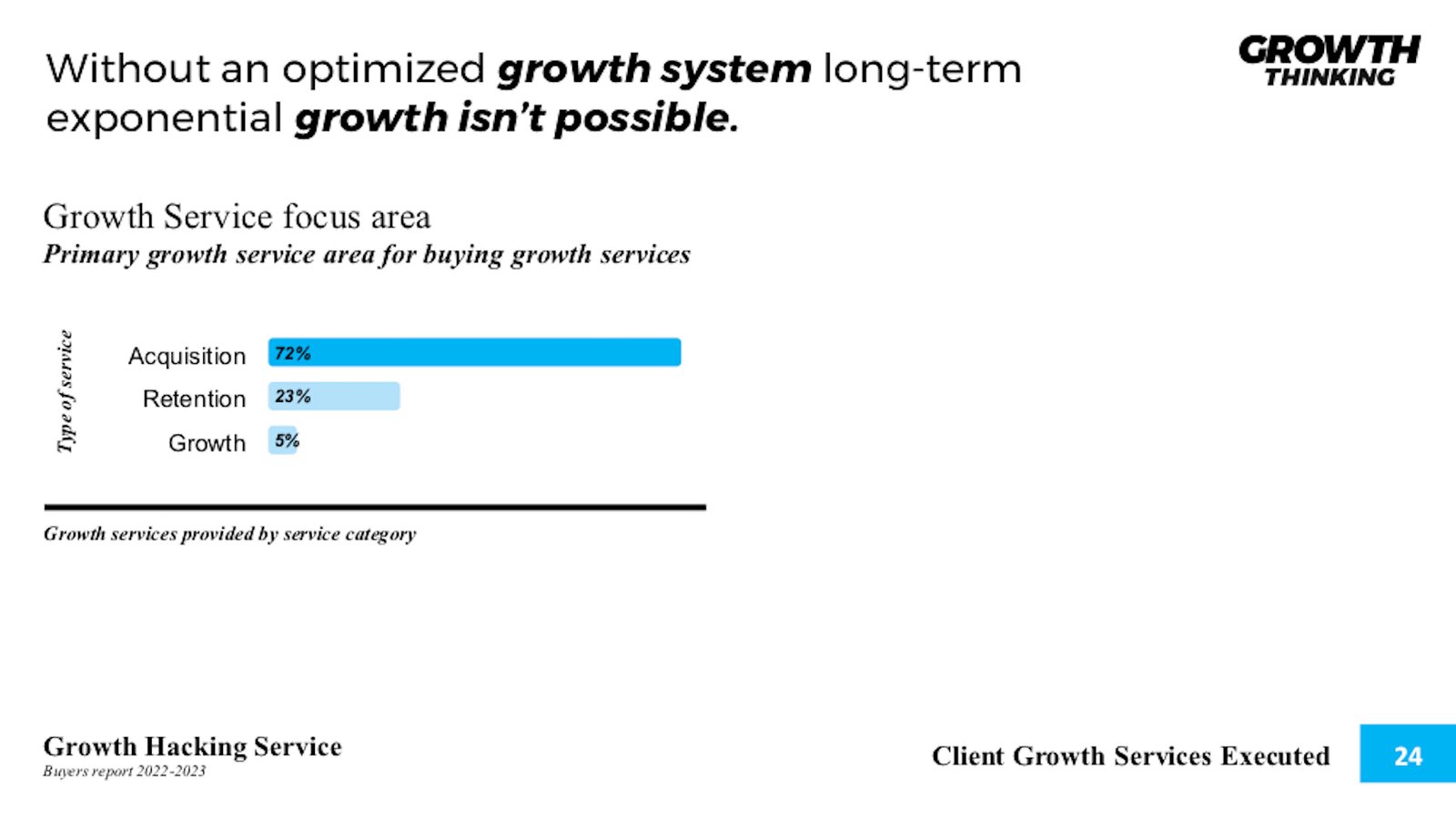

Without an optimized growth system, long-term exponential growth isn’t possible

Growth Service focus area

72% of growth activities are focused on revenue acquisition. There is three times more focus on acquisition vs. retention, which creates a growth leak

65% of growth activities, which is your team’s priority for the next 12 months, are acquisition efforts according to The State of Growth 2021. Retention is at 32%, accounting for half the focus of resources and efforts. This also indicates a growth leak

ackground

Growth leaks are where a growth system cannot balance the three main growth activities: revenue acquisition, customer retention, and growth. The three components work in sequence, you acquire, retain and grow revenue. If one of the three components is not aligned, well resourced, or not well optimized, you will have a growth leak.

Context

Without robust revenue acquisition, the whole growth system doesn’t work. Still, without a way to capture the revenue optimally, it’s an ongoing issue, and this is one of the top-level switching reasons that is not seen. This is not visible because the three components are NOT seen collectively but instead need to be seen as a single and integrated growth system. This is further emphasized by 56% of organizations with a growth system. About 4% of organizations have optimized their growth system. Half a percent have harnessed their growth system for exponential growth. Optimized growth systems are rare.

Takeaway

Building a growth system is vital to sustaining long-term exponential growth. This enables clients to have the power to work with freelancer agencies and their own in-house growth services or even create their own hybrid processes to work between internal and external growth services.

Subscribe for updates

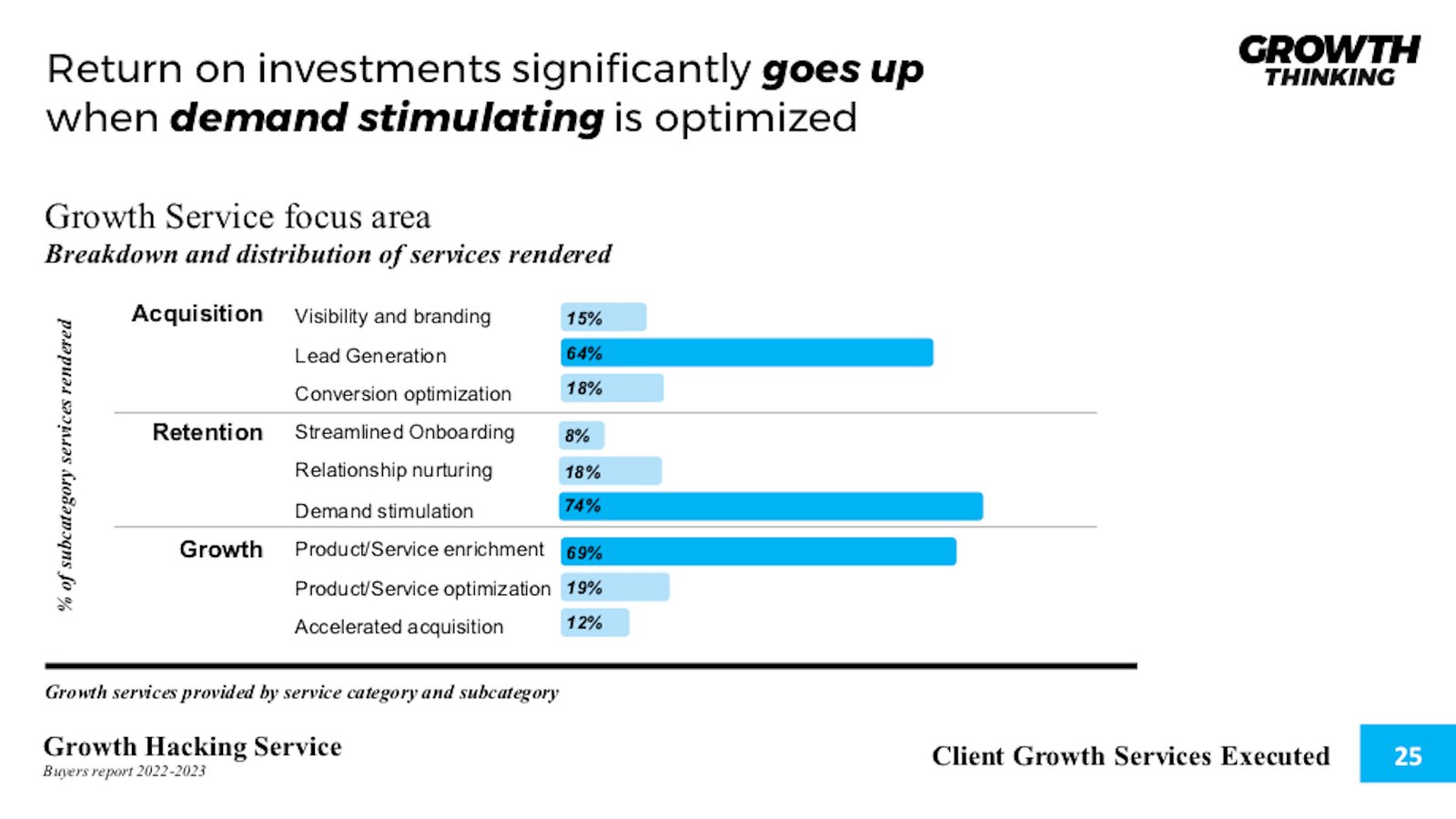

Return on investments significantly goes up when demand stimulating is optimized

Growth Service focus area - by subcategory services,

The highest focus area is Demand stimulation activities at 74% under retention efforts. This supersedes other subcategory services as once a solid growth system is in place, one of the sweet spots for enhancing growth is Demand stimulation activities.

A 5% increase in retention produces a 25% increase in profit, a significant focus area for demand stimulation as the main purpose.

Background

Demand stimulation activities are a natural evolution of a robust growth system. Once revenue has been acquired and retention activities occur, stimulation activities are possible. The main goal is to increase consumption, which is undertaken by looking into

- Value creation,

- Value enhancement,

- Value-added activities, and

- Value realignment

These value-focused activities are optimal at the Demand stimulation stage. This is because the initial value has been established, but the value needs to evolve to retain further and grow revenues. This is often best in evaluating problems created:

- your solution as a byproduct,

- issues not addressed well enough, and

- issues not addressed at all.

Getting pinpoint-focused on creating superior value based on an already established trusted relationship creates significant growth at a much lower cost.

Context

A growth system is vital to stimulating demand; when the growth system is well optimized, this enables overall growth to become exponential. This is even more valuable to growth when you can stimulate more demand for retention purposes. When this is done well, not only does retention work better, but the next step of growing existing revenue becomes much more accessible. This paves the path for long-term and more sustainable exponential growth.

Takeaway

Return on investments significantly goes up when stimulating demand works. The initial cost of customer acquisitions goes down with time and the customer lifetime value goes up. In some cases, utilization rates within the total lifetime value dramatically increase with a 90%+ impact on overall gross revenue.

Investing in growth management systems is the top priority for organizations

Success Rate for - Growth Service provided by growth service category

47% of acquisition activities have a success rate of 10 to 50%. Comparatively, this is higher than the average 10% or less success rate for retention and growth activities.

Around 30% of respondents in a study conducted by Databox agreed that 3.1% to 5% is a reasonable funnel conversion rate.

Background

Failure rates, in general, are high across all three service categories (acquisition, retention, and growth). Organizations that run their growth units have indicated that 51% of challenges in growth activities are in the growth process itself. If the procedure governing the outcomes is not stable, the failure rate will naturally be high. Roughly 34% of growth experiments have a 25 to 50% success rate. Those experiments are not the final results, just part of the process of implementing growth hacks, as scaling and turning them into full-scale operations is still not accounted for.

Context

No more than 8% of all growth activities will yield a 75% or more success rate across all three categories of growth activities (acquisition, retention, and growth). Better growth processes are needed to manage the growth process to yield higher success rates. This is a direct input vs. output relationship.

Takeaway

Investing in developing growth processes to manage growth is the top priority for organizations to gain control of their growth, yield better outcomes, lower acquisition costs, and increase customer lifetime value.

expert opinion

"It’s usually a lack of systems that hinders a company’s growth because acquiring the client is merely the beginning"

A lot of people and companies spend money on the acquisition of clients and customers, but often they forget that it’s the customer’s entire life cycle with you that’s most important. It’s usually a lack of systems that hinders a company’s growth because acquiring the client is merely the beginning. How are they nurturing them for every other step of the process?

Additionally, if there was an increase in the prioritization of systems within the organization, the people fulfilling the services would be able to maximize their output, which in turn favors the retention of current clients without the hindrance of welcoming new ones. There’s a delicate balance between the people who work in an organization and the ones that serve, so it’s imperative to consider how systems affect the entire operation.

There’s nothing wrong with focusing heavily on new business, but it’s what an organization does after it acquires new business that defines more predictable and consistent growth.

The future belongs to the companies that are already actively implementing systems way beyond acquisition if it’s to see consistency and long-term sustainability.

Growth is a science and art for unlocking creativity in the growth hacking process

Return of investment for – Growth Service provided by growth service category

The highest return on Investment experienced is in the acquisition stage at 51 to 100% returns. Although half of the acquisition activities account for 50 to 100%+ returns, this diminishes retention and growth activities.

Over 50% of companies surveyed for defining their North Star Metric either do not have one or don’t use a north star metric. A north star metric is a single number used as the key indicator of growth and has the most impact on all sub-activities that result in growth.

Background

Having a growth system connects all three major growth activities (acquisition, retention, and growth). However, the absence or the ineffective usage of a growth system entails leakages in growth in later stages. All three activity areas (acquisition, retention, and growth) need to feed and reinforce each other to sustain long-term exponential growth.

Context

Without a clear correlation between components in your growth system, bringing all three phases (acquisition, retention, and growth) together will result in growth leakages. Powerful analytics are needed to measure every step, the handovers between steps, and understand the impact both forward and backward and implications. Data-driven growth decision-making is the critical competency required to make this work.

Takeaway

Measuring growth is a science but needs to be treated as art to unlock the creativity of the growth hacking process but still keep the right measures in place. All measures need to be designed to leverage optimization controls; this enables flexibility and a better understanding of your growth.

expert opinion

"Those businesses that feel they have achieved higher ROI on acquiring clients are probably spending the least amount on growth."

Subscribe for updates

Growth is a science to be mastered if you want to 10x or even 100x your business.

Developing your in-house capabilities and capacity is vital to your short and long-term growth. This gives you the power to either work entirely in-house at any time or create a hybrid situation where you can use your in-house capabilities combined with external agencies or freelancers.

This hybrid approach gives you the ability to tap into the depth of expertise. This will provide you with the advantage of a cost-effective model, where the low-value activities are done internally to be controlled, and high-value activities which are harder to access can be brought inwards via external sources.

Growth Hacking Service Report

Nader Sabry

Learn more about Nader Sabry

Methodology

This analysis aims to understand the current state of Growth Hacking service buyers. Specifically, to gather benchmarks for spending, service consumption, and switching patterns, we also deeply analyzed a subset of top-performing companies with the most usage and requirement for growth services. We started with this base to focus on those with the highest interest in growth hacking services.

To our knowledge, this is the first large-scale analysis of growth hacking and growth services buying behaviors. This study serves as a benchmark for growth service providers to better position their benefits.

Buyers

Buyers are companies who have purchased growth services designed to increase their business’s gross revenue. The following criteria were used:

- Have purchased growth services within the past 6 months,

- Have purchased growth services from 3 or more separate providers, and

- Have spent more than $1,000 a month on growth services.

Data acquisition

Data is obtained through primary sources via a direct survey.

Only complete validated and verified surveys are accepted, with a confidence level of 95%+ and a margin of error of 5%. Data collected is verified and validated as confirmation with participation before publishing. Secondary data is collected via desk research to validate and give context to primary data.

In addition, interviews with industry experts provide independent data and context to existing data collected as background and expert opinions.

Profile

The primary survey has 2,150 participants across ten different industries and six different geographic regional locations. The buyers are senior executives who are the primary decision-maker for buying the growth services themselves.

Future updates have been designed in the data collection methods to provide provisions for expanding on the existing data and further collection for systematic analysis.

Approach

We started by identifying companies that have used growth services within our criteria. We sourced them via CrunchBase, Inc 5000 and a Google News search for the latest filings for Round A, B, or C at a minimum of $2,0000,000.

Once identified, we approach them with our survey targeting their most identifiable and most senior persons responsible for growth; if not, we would resort to the CEO or Founder.

Once the survey had been completed and analyzed, the results were put in front of experts in the field to get expert opinions to give further context and other forms of data they may be able to share to provide more depth and context to our findings.

Constraints

Often, we come across a lack of willingness to want to discuss failures and challenges related overall to their growth. Therefore completion rates were a challenge but only completed surveys have been incorporated into the results of this study. Internal data collection and analysis were limited and did not serve the participants in giving further insights in many cases.

Profile

The primary survey has 2,150 participants across ten different industries and six different geographic regional locations. The buyers are senior executives who are the primary decision-maker for buying the growth services themselves.

Future updates have been designed in the data collection methods to provide provisions for expanding on the existing data and further collection for systematic analysis.

Sources and other studies

The following are studies and sources with a well-established position and credibility in the growth hacking industry. Most of these studies cover internal growth challenges and how to overcome them in macro-data or industry trends based on pure digital means not looking wide enough across the whole growth spectrum.

The most fundamental aspect here is that they don’t cover Growth Service Buying behavior. Although we can gain deeper technical insights, these studies do not cover buying behaviors. Buying behaviors are critical building blocks that shape almost everything discussed in these studies. The lowest common denominator is the adoption of growth services, and that only happens with growth service buyers purchasing and utilizing growth services.

- Growth Hacking: Stats and Trends for 2022

- What is Growth Hacking in 2022?

- Andrew Chen on the state of growth hacking

- The Growth Hacking Playbook: Your Ultimate List of Growth Hack Resources

- The State of Growth 2021

- 10 Reasons Why a Growth Marketing Agency Will Get You Better Results

- Study reveals that most companies are failing at big data

- Prescription for cutting costs

- HBR – The Value of Keeping the Right Customers

- Cost of Acquiring New Customers vs. Retaining

- Returning Customers Spend 67% More Than New Customers

- Customer Acquisition Vs. Retention Costs – Statistics And Trends

- What’s a Good Funnel Conversion Rate?

- MEASURING THE ECONOMIC IMPACT OF SHORT-TERMISM

- Spending on digital transformation technologies and services worldwide from 2017 to 2025

- How Digital Agencies Grow

- Freelance Market Statistics & Trends [Updated for 2022]

- 60+ Freelance Stats – Why the Gig Economy is Growing in 2022

- The growth rate of U.S. agency revenue from 2009 to 2020, by discipline

- How Outsourcing is a growth hack for every Startup

- The Outsourcing Revolution

- Andrew Chen on the state of growth hacking

- SaaS Metrics 2.0 – A Guide to Measuring and Improving what Matters

- Our 2021 Outreach Stats Revealed + The Art of LinkedIn Outreach

- Customer Onboarding Statistics 2020

- Growth ninja School – growth hacking training and development

- 29 Crucial Intellectual Property Statistics

- 39 Best Growth Hacking Agencies in 2022

Participation profile

The following is the profile of those who have completed the survey and agreed to be part of the study.

Survey Participant breakdown |

|

Profile of data about the survey itself | |

Total participants | 2,150 |

Total circulation | 3,456 |

Margin of error | 5% |

Confidence Level | 95% |

Avg time to complete | 23 min |

Sources | 25+ |

Experts | 18+ |

Industry |

|

Industry of participants | |

Automotive | 1% |

Entertainment | 4% |

Financial services | 10% |

Food & Beverage | 12% |

Health | 18% |

Manufacturing | 4% |

Media | 11% |

Professional services | 14% |

Retail | 3% |

Technology | 23% |

Survey Participant Geography |

|

geographic location | |

North America | 38% |

Europe | 24% |

Middle East | 12% |

Asia | 17% |

South America | 2% |

Other | 7% |

Survey Participant Revenue size |

|

Annual gross revenue | |

< $500k | 7% |

$501k – $1m | 26% |

$1m – $5m | 46% |

$5m – $50m | 12% |

$50m + | 9% |

Survey Participant Employee size |

|

Annual gross revenue | |

< 10 | 12% |

11 to 50 | 38% |

51 to 100 | 24% |

101 to 500 | 18% |

500+ | 8% |

Growth Rates |

|

Average annual growth rate of participants | |

0 | 3% |

< 10% | 9% |

10- 50% | 62% |

51- 100% | 19% |

+100% | 7% |

Usage growth Hacking services |

|

Initial usage patterns of growth services | |

3x times | 91% |

4-5x times | 6% |

6-10x times | 2% |

11x times | 1% |